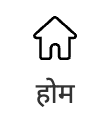

The BRICS Business Council has announced a new milestone in financial innovation with the proposed launch of BRICS Pay, a service for cashless payments by foreigners, by the end of this year in Russia. This significant development aims to facilitate seamless transactions for international visitors using a QR code-based payment system.

The announcement was made during the BRICS Business Council’s Financial Services working group meeting in Moscow, led by Andrey Mikhailishin, head of the BRICS Payments and Fintech subgroup. The event, held from October 17-18, brought together key stakeholders to discuss the implementation of this innovative solution, which will enable foreign tourists and business travelers to pay using Visa, Mastercard, and, in the future, Russia’s domestic Mir cards.

A Revolution in Cashless Payments

Mikhailishin highlighted that BRICS Pay will streamline payment processes for foreigners, offering an accessible, user-friendly platform. Users will be able to link their bank cards to the BRICS Pay app, available soon on both the App Store and Google Play, allowing payments by scanning QR codes at retail points or generating codes for cashier scans. This system will cover major Russian cities and cater to high-traffic tourist and business areas.

Foreigners from any country, not limited to BRICS member states, will be able to use BRICS Pay with cards in their national currencies, as well as in dollars and euros. Ongoing negotiations are also underway to integrate China’s WeChat Pay into the platform, broadening its global appeal.

Looking Forward: Expansion Beyond Borders

The BRICS Pay initiative represents more than just a domestic solution. By mid-2025, the system is expected to extend to Russians traveling abroad, with initial implementations planned for popular tourist destinations such as Turkey, Egypt, Sri Lanka, and the Maldives. The service is set to enhance convenience for Russians, eliminating the current challenges posed by international sanctions, which restrict the use of Visa and Mastercard cards outside Russia.

Moreover, BRICS Pay will cater to labor migrants, offering a simplified method for transferring funds through Russia’s banking system. This will allow migrants to top up their accounts locally while enabling their families abroad to access funds seamlessly.

Technical Feasibility and Global Impact

Experts believe that Russia’s extensive financial infrastructure, backed by the technical expertise of its largest banks, is well-equipped to support BRICS Pay’s implementation. With cross-border payment systems already in place, such as the Financial Messaging Transfer System (FMS) and other solutions developed by the Bank of Russia, the BRICS countries are positioned to lead a new wave of financial cooperation.

Nikolai Novik, associate professor at the Financial University under the Government of Russia, emphasized that with BRICS’ expanding international ties, the demand for innovative financial services will only increase. While Western sanctions pose potential challenges, BRICS Pay could offer a viable alternative for both domestic and international users.

A New Era for Cross-Border Payments

BRICS Pay aligns with broader efforts by the BRICS nations to reduce dependency on traditional international payment systems and diversify their financial portfolios. The Russian Ministry of Finance and Central Bank, along with industry experts, have outlined a vision for enhancing cross-border transactions. This includes proposals for using national currencies in BRICS settlements and establishing direct links between the central banks of BRICS countries.

The launch of BRICS Pay represents a forward-thinking step toward economic cooperation and financial independence among the BRICS nations, as well as the global community.

Subscribe Us

Subscribe Us